BAGHDAD: Iraq’s foreign-currency reserves will continue to climb after reaching $67 billion in the last three weeks amid higher oil revenue, said Mudher Saleh, deputy governor of the country’s central bank.

The reserves will reach $70 billion by the end of the year provided oil exports continue to grow, Saleh said by telephone today from Baghdad. In January, Saleh said reserves had reached a record $60 billion.

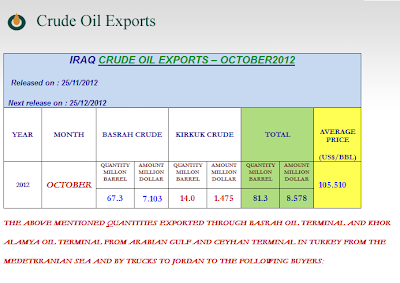

Violence and political clashes have intensified following the US withdrawal in December of the remaining troops it deployed in Iraq after the 2003 invasion that ousted Saddam Hussein. Iraq’s federal government and the self-governing Kurdish region disagree over how to manage oil revenue. Crude exports from Iraq, which holds the world’s fifth-largest crude reserves according to BP Plc statistics that include Canadian oil sands, rose in July to an average of 2.52 million barrels a day, Falah al-Amri, the head of the State Oil Marketing Organization, said on Aug. 1.

Interest rates will probably remain unchanged at 6 per cent as “it is logical and compatible with core inflation,” Saleh said. Lowering rates will “encourage the fleeing of money outside the country,” he said.

The government’s plan to remove zeros from the new dinar denominations is on hold and “may happen in 2014 or the following years,” he said. “It is not an easy process.”

Auctions of US dollars, on which Iraq imposed tighter control to curtail the impact of the dinar’s fluctuation, still sell an average of $260 million and $280 million a day, he said. About 80 percent of the dollars sold in auctions cover “visible” trade and the rest involve non-visible trade such as services, tourism and insurance, he said.

The reserves will reach $70 billion by the end of the year provided oil exports continue to grow, Saleh said by telephone today from Baghdad. In January, Saleh said reserves had reached a record $60 billion.

Violence and political clashes have intensified following the US withdrawal in December of the remaining troops it deployed in Iraq after the 2003 invasion that ousted Saddam Hussein. Iraq’s federal government and the self-governing Kurdish region disagree over how to manage oil revenue. Crude exports from Iraq, which holds the world’s fifth-largest crude reserves according to BP Plc statistics that include Canadian oil sands, rose in July to an average of 2.52 million barrels a day, Falah al-Amri, the head of the State Oil Marketing Organization, said on Aug. 1.

Interest rates will probably remain unchanged at 6 per cent as “it is logical and compatible with core inflation,” Saleh said. Lowering rates will “encourage the fleeing of money outside the country,” he said.

The government’s plan to remove zeros from the new dinar denominations is on hold and “may happen in 2014 or the following years,” he said. “It is not an easy process.”

Auctions of US dollars, on which Iraq imposed tighter control to curtail the impact of the dinar’s fluctuation, still sell an average of $260 million and $280 million a day, he said. About 80 percent of the dollars sold in auctions cover “visible” trade and the rest involve non-visible trade such as services, tourism and insurance, he said.